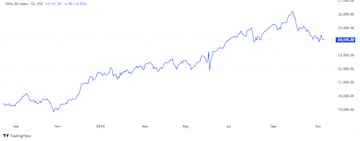

For a better part of Monday's trading session, it felt as though the Nifty would have had a positive start to the truncated week. But as has been the case for most of last month, the bulls yet again struggled to find confidence at higher levels, and the result was yet another close below the flat line.

The Nifty fell 200 points from the highs of the day and while banks and IT were the primary contributors to the gains on Monday, their correcting from the day's high dragged the Nifty lower as well. The strength in IT and Banks was offset by weakness seen in FMCG, Pharma and Metal stocks.

Disappointing earnings continued among the Nifty constituents with Asian Paints delivering another weak quarter and that showed in the 8% fall in its stock price, back to levels of May 2021. The stock also was the top Nifty 50 loser. Earnings reactions from within the Nifty 50 will come from stocks like Britannia, Hindalco and ONGC.

As we wind down to what has been a disappointing earnings season, multiple brokerages have trimmed earnings estimates for most of the companies under their coverage. It is for this reason that the market is unable to exhibit confidence at higher levels and remains stuck in a range, despite Wall Street continuing to notch record highs almost every day post Donald Trump's election victory.

However, stocks with strong results are getting rewarded too, as was evident in moves seen in stocks like Shipping Corporation of India and PFC.

The Nifty remains stuck in a range. This is a truncated week and hence trading activity may remain thin as well. The 23,800 - 24,500 is a broad range for the index but narrowing it down leads one to 24,100, followed by 24,000 on the downside as the key support levels to watch for the index. Monday's high of 24,337 will be the first hurdle to cross for the Nifty on Tuesday, which also happens to be the weekly expiry for the financial services index.

Earnings reactions will also come from broader market names like NMDC, Hindustan Copper, Shree Cement, Bank of India, Fertilisers, Awfis Space Solutions among others.

Bosch, Medplus Health Services, Samvardhana Motherson and Suven Pharma are some important results to be reported on Tuesday.

The Nifty has crucial support between 23,800 - 24,000 levels, which need to be maintained to sustain the overall positive bias, said Vaishali Parekh of Prabhidas Lilladher.

Rupak De of LKP Securities said that the momentum indicator RSI has shown a bullish crossover and the Nifty on the daily chart has also formed an inverted hammer pattern, indicating a possible bullish reversal. He expects the Nifty to move to 24,500 - 24,550 levels, while support is at 24,000.

The underlying trend of the Nifty remains choppy with a weak bias, said Nagaraj Shetti of HDFC Securities. He expects the Nifty to witness an upside bounce from the lower end of the range near 23,800 levels, with 24,300 seen as an immediate resistance.

The Nifty Bank emerged as the outperformer in Monday's trading session, witnessing gains of over 300 points but could not sustain above the 52,000 mark yet again, correcting 300 points from the highs of the day. The index traded in a 1,000-point range on Monday and levels therefore are slightly skewed. Monday's high of 52,177 will be important to track on the upside, while the low of 51,294 on the downside will be key to monitor.

Hrishikesh Yedve of Asit C Mehta Investment Interrmediates said that the Nifty Bank has formed a green candle on the daily chart after taking support at its 100-Day Exponential Moving Average. If the index does manage to sustain above 52,580 levels, only then can it trigger a fresh upmove. Else, the consolidation may continue.

What Are The F&O Cues Indicating?

Nifty 50's November futures shed 0.4% or 39,650 shares in Open Interest on Monday. They are now trading at a premium of 85 points from 71.65 points earlier. On the other hand, Nifty Bank's November futures shed 2.4% or 63,060 shares in Open Interest on Monday. Nifty 50's Put-Call Ratio remains unchanged at 0.91.

Aarti Industries and Hindustan Copper have entered the F&O ban, along with Aditya Birla Fashion, Granules India and Manappuram.

Nifty 50 on the Call side for November 14 expiry:

On the Call side, the Nifty 50 strikes between 24,250 and 24,400 have seen Open Interest addition for this Thursday's weekly expiry.

| Strike | OI Change | Premium |

| 24,300 | 14.52 Lakh Added | 57.65 |

| 24,400 | 9.92 Lakh Added | 32.85 |

| 24,250 | 8.28 Lakh Added | 75.1 |

Nifty 50 on the Put side for November 14 expiry:

On the Put side, the Nifty 50 strikes between 23,950 and 24,100 have seen Open Interest addition for this Thursday's weekly expiry.

| Strike | OI Change | Premium |

| 24,000 | 9.82 Lakh Added | 58.65 |

| 23,950 | 8.89 Lakh Added | 45.85 |

| 24,100 | 3.88 Lakh Added | 92.65 |

Fresh long positions were seen in these stocks on Monday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| PI Industries | 1.03% | 10.26% |

| Federal Bank | 0.50% | 4.61% |

| Oracle Financial | 3.54% | 4.23% |

| Coforge | 1.32% | 4.20% |

| Hindalco | 1.01% | 3.98% |

Fresh short positions were seen in these stocks on Monday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| Asian Paints | -8.26% | 18.72% |

| Aarti Industries | -7.37% | 17.77% |

| Shree Cement | -0.64% | 11.68% |

| Jubilant Foodworks | -0.32% | 11.40% |

| Britannia | -6.06% | 11.21% |

Short covering was seen in these stocks on Monday, meaning an increase in price but a decline in Open Interest:

| Stock | Price Change | OI Change |

| ABB | 2.49% | -7.54% |

| Ashok Leyland | 0.70% | -5.66% |

| SBI | 0.44% | -3.47% |

| Manappuram Finance | 1.79% | -3.40% |

| Abbott India | 0.75% | -3.39% |

These are the stocks to watch out for ahead of Tuesday's trading session:

Hindalco: Novelis business does well after Hindalco disappointment. Aluminium business beat backed by lower input costs and higher average aluminium prices. Copper business beat needs to be checked for a one-off as metal shipments down 13% year-on-year. Aluminium EBITDA at ₹3,863 crore, higher than poll of ₹3,274 crore. Copper EBITDA up to ₹829 crore, higher than poll of ₹628 crore.

Britannia: Net profit down 9.4% to ₹531.6 crore, lower than poll of ₹616 crore. Revenue up 5.3% to ₹4,667.6 crore, in-line with estimates of ₹4,697 cror. EBITDA down 10.2% to ₹783.4 crore, lower than poll of ₹890 crore. Margin narrows to 16.8% from 19.7% last year and lower than the poll of 18.9%.

ONGC: Net profit up 34% to ₹11,984 crore, higher than estimates. Revenue down 4% to ₹33,881 crore but higher than estimates. EBITDA flat at ₹17,025.2 crore, marginally below estiates of ₹17,199 crore. EBITDA margin at 50.3% from 48.1% in June and lower than poll of 51.7%. Board recommends interim dividend of ₹6 per share.

NMDC: Revenue of ₹4,918 crore, higher than poll of ₹4,681 crore. EBITDA, margin, net profit below estimates. Gross margins contract due to higher than expected stock adjustment, basically sold older inventory as production was lower. Next quarter will be better as price hikes have been taken in Q3FY25. Gross margins at 86% from 90% last year. Board recommends 2:1 bonus.

Bank of India: Net profit up 62.8% to ₹2,373.7 crore. Net Interest Income up 4.3% to ₹5,985.2 crore. Gross NPA at 4.41% from 4.62% in June. Net NPA at 0.94% from 0.99% in June.

Ramco Cements: Revenue at ₹2,038 crore, in-line with estimates of ₹2,055 crore. EBITDA of ₹312 crore, higher than poll of ₹259 crore. Net profit of ₹25.6 crore, compared to expectations of ₹10 crore loss. EBITDA margin at 15.8%, higher than poll of 12.6%. Sales volume down 2.6% year-on-year, better than estimates of a 5% decline. Additionally entered into a sale agreement for disposal of lands worth Rs.74 Cr, expected to be realized during the December quarter. Net debt at ₹5,103 crore.

1 week ago

1 week ago