Stoxbox recommends taking a long position in 212.50 CE above 9.50, keeping 4 as an immediate support and targeting 20 and 24 as profit levels

April 02, 2024 / 10:50 AM IST

The volume on the counter has surged above the 20-session average, indicating increased buying interest.

Bharat Electronics shares spur fresh upside as derivatives data indicates a long build-up with addition of 53 lakhs contracts. The stock closed up over 4 percent on April 1, with aggressive structure along with adding substantial open interest (OI).

Volume on the counter has surged over the last 20 sessions average indicating buying interest.

At 9.41 am on April 2, Bharat Electronics was trading at Rs 217.50, up 6.40 points, or 3.03 percent.

Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, said, "The breakout supported with volumes strengthens the upwards bias. Strike prices of 210 CE and 220 CE have seen robust addition in OI, with 212.50 PE noticing a writing scenario. The structure denotes a bullish bias, as the price is anticipated to reach 220 and 227 levels in the following sessions."

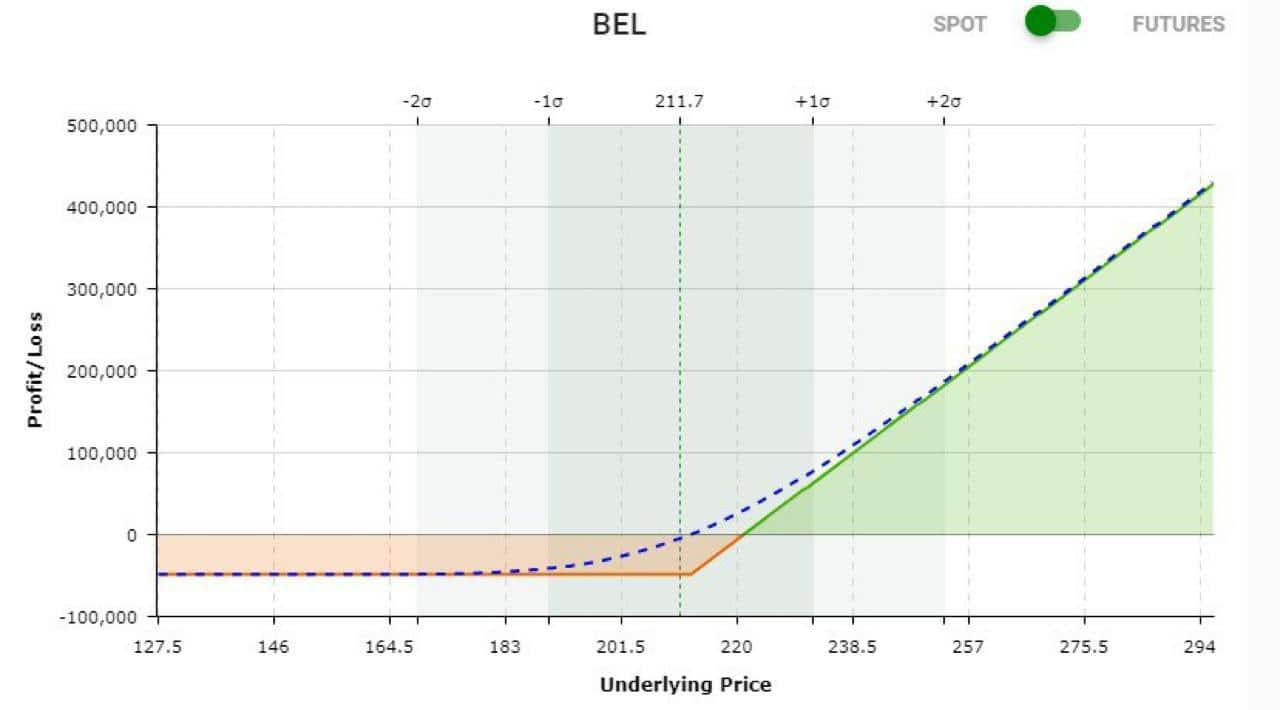

Payoff Chart of Bull Call strategy on BEL Counter| Source: Stoxbox

Payoff Chart of Bull Call strategy on BEL Counter| Source: Stoxbox

Bagkar said the technical and OI thesis signify an optimistic bias, as bulls have taken the front seat.

Bull Call Derivative strategy recommended by Bagkar

Holding period: One-two weeks

Position: Buy BEL 212.50 CE April 25, 2024 above Rs 10

Target: Rs 20-24

Stop loss: Rs 4

"We advocate taking a long position in 212.50 CE above 9.50, keeping 4 as an immediate support, and targeting 20 and 24 as profit levels, " Bagkar said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

1 month ago

1 month ago