Starting January 2026, under the newly revised Value-Added Tax Law, Chinese citizens will be required to pay a 13 per cent levy on all contraceptive items, including condoms.

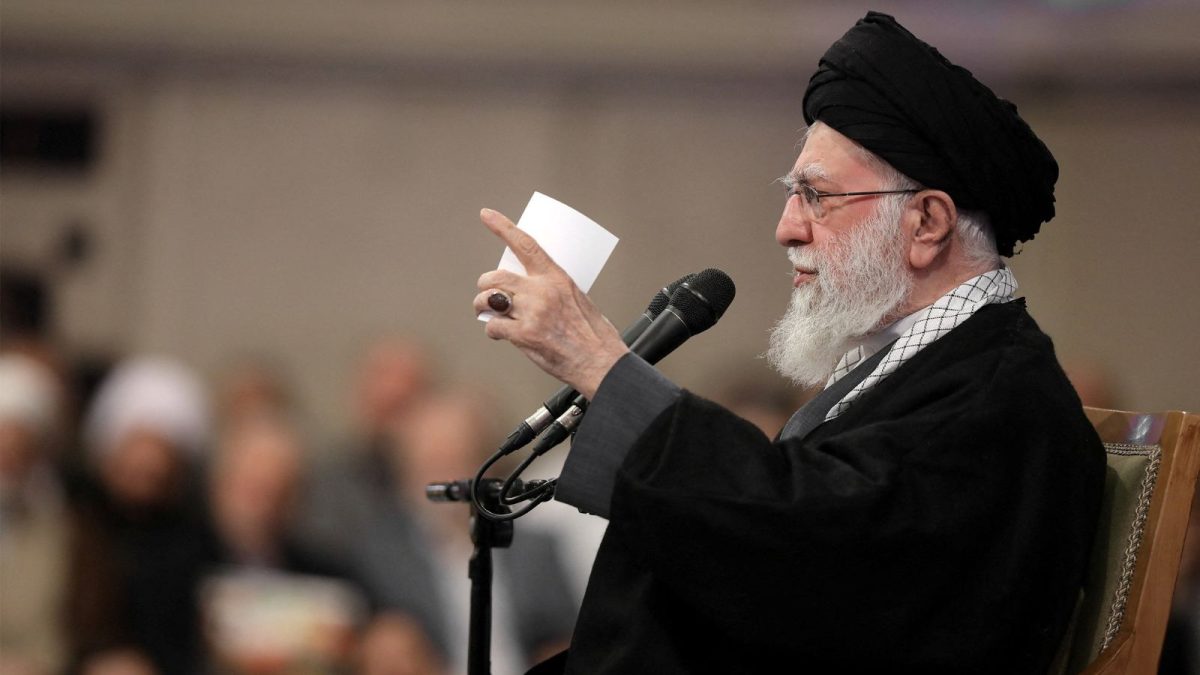

China is offering a host of measure to boost the gradually declining birth rate. (Photo: Representational Image)

In a major policy reversal after 32 years, China is set to impose a tax on condoms in an effort to boost birth rates amid a steady decline.

Starting January 2026, under the newly revised Value-Added Tax Law, Chinese citizens will be required to pay a 13 per cent levy on all contraceptive items, including condoms.

These products have enjoyed tax-free status since 1993, when the world's second-largest economy promoted birth control under the stringent one-child policy implemented from 1980 to 2015.

The government, however, is yet to officially comment on the development.

In a bid to boost the birth rate, authorities have implemented a host of other measures, including local governments offering cash rewards for newborns, extension of parental leave, and discouraging abortions that are not considered “medically necessary."

DROP IN CHINA'S BIRTH RATE

The new effort comes in the wake of China's population falling for a third consecutive year in 2024.

In a report in January, the Bureau of Statistics announced that the total number of people in the Asian giant dropped by 1.39 million to 1.408 billion in 2024, compared to 1.409 billion in 2023.

The total number of births in the country was 9.54 million versus 9.02 million in 2023, according to the report. The birth rate rose to 6.77 births per 1,000 people in 2024 versus 6.39 per 1,000 people in 2023.

According to the UN, the number of Chinese women of reproductive age -- 15-to-49 -- is set to drop by more than two-thirds to under 100 million by the end of the century.

- Ends

Published By:

Karishma Saurabh Kalita

Published On:

Dec 3, 2025

1 month ago

1 month ago