Sandip Agarwal, Fund Manager at Sowilo Investment Managers and Bhavin Shah, Founder CIO & CEO of Sameeksha Capital flag high valuation and execution risks in Coforge’s Encora acquisition, warning of limited near-term upside amid a slowing Indian IT sector and rising AI-led disruption.

By Alpha Desk December 29, 2025, 4:16:34 PM IST (Published)

Market experts have voiced caution regarding Coforge's recent acquisition of Encora, a significant all-stock deal described as a 'bold transformational' move.

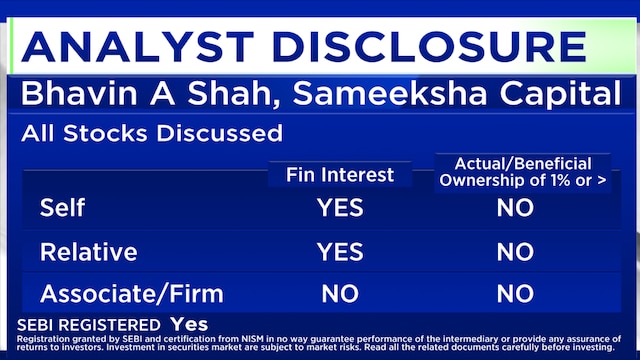

In a discussion, Sandip Agarwal, Fund Manager at Sowilo Investment Managers and Bhavin Shah, Founder, CIO & CEO of Sameeksha Capita,l dissected the implications of the deal for Coforge and the broader information technology (IT) sector, with both expressing reservations about the high valuation and near-term prospects.

Agarwal acknowledged the strategic intent behind the acquisition but highlighted the significant risks involved. "There is very limited story of successes in such a kind of acquisition," he said, pointing to high integration and execution risks. However, he found a silver lining in the deal's all-stock structure, stating, "One good thing in the deal is obviously it is an all-stock deal. So, everyone's outcomes are completely connected." An cash deal would have been worrisome.

Despite this, the high price remains a major concern. Agarwal said that at this valuation, "the onus on meticulous execution is very high and also the margin of error is very low." While he is confident about Coforge's management, he maintained a broadly negative view of the IT sector.

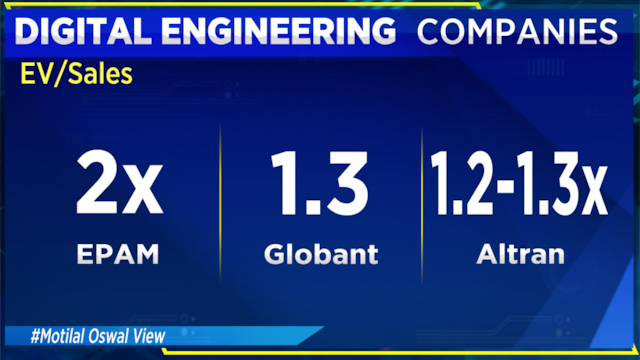

Shah echoed the concerns about the valuation, pointing out that Coforge is acquiring Encora using a very expensive stock. He also suggested a broader trend, stating that changes to tax rules on dividends and buybacks might incentivise companies to pursue more acquisitions.

Also Read: Coforge’s AI deal makes sense, but tier-1 IT firms still have the edge: Wedbush’s Moshe Katri

When asked about the investment case for Coforge, both experts were unequivocal. Agarwal, citing his negative outlook on the entire sector for the next 12 to 18 months, stated, "We don't hold any position nor intend to hold anything immediately." He explained that his firm uses the Price/Earnings-to-Growth (PEG) ratio for valuation, on which basis he finds the entire sector "super expensive."

Shah concurred, highlighting the stock's low cash flow yield. "We don't own it, and we don't intend to buy it," he confirmed.

Discussing the wider IT industry, Agarwal predicted a prolonged period of subdued growth. He anticipates that large-cap IT firms will see a Compound Annual Growth Rate (CAGR) of 5-7%, with mid-caps in the Engineering, Research and Development (ER&D) space faring slightly better at 10-12%. He attributed this to the disruptive impact of artificial intelligence (AI), which he believes will cause a 30% reduction in effort required for services, fundamentally capping growth. "This is like any other industry which matures," he said, arguing that growth expectations and valuation multiples must systematically come down.

In contrast, Shah revealed a more selective investment approach, mentioning holdings in Infosys, Mastek, and other IT-related distributors like Redington. This suggests he sees pockets of value and growth even within a challenging environment.

Regarding the possibility of a sector-wide merger and acquisition (M&A) trend to shore up growth, Agarwal was sceptical. He praised the pragmatism of Indian IT management, asserting they would not be pressured into acquisitions. "I am pretty confident that they will do the right things," he concluded, stressing that the industry's maturity necessitates an acceptance of lower growth rates.

Also Read: Titan’s lab-grown diamond entry cuts uncertainty; Coforge AI deal a long-term bet: PL Capital

For the entire discussion, watch the accompanying video

1 month ago

1 month ago