Last Updated:July 30, 2025, 10:10 IST

Despite intensifying pressure from the White House, the US Federal Reserve is widely expected to keep its benchmark interest rate unchanged

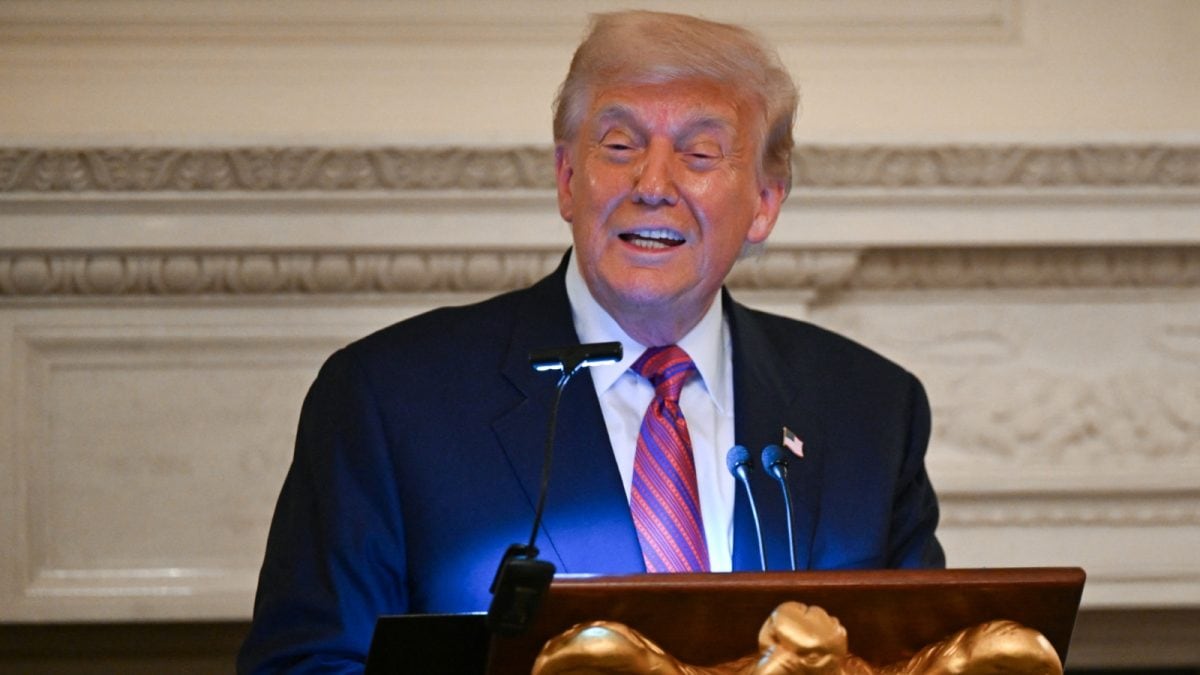

US President Donald Trump looks on as Jerome Powell, chairman of the US Federal Reserve, as he speaks at the White House in Washington, US. (Image: Reuters)

Despite intensifying pressure from the White House, the US Federal Reserve is widely expected to keep its benchmark interest rate unchanged at its upcoming policy meeting on July 30. The Federal Open Market Committee (FOMC) has held rates steady in the 4.25%–4.5% range for four consecutive meetings—and appears set to extend that streak.

US President Donald Trump has openly criticised Fed Chair Jerome Powell for maintaining elevated rates, arguing that the central bank is keeping borrowing costs unnecessarily high and slowing down economic momentum. Trump has called for a sharp 300 basis point rate cut, a demand that has fueled debate in policy circles but failed to sway the Fed’s position—at least for now.

Fed Chair Powell, however, has maintained that more data is needed to determine the appropriate course of action, especially given heightened uncertainty around trade policies. The latest inflation reading came in at 2.7%, making an immediate rate cut unlikely, according to most economists.

Goldman Sachs: No Hint This Week, Cut Likely in September

Goldman Sachs, in a research note, said the key shift since the Fed’s last meeting has been signs of slower economic activity—largely a result of the President’s tariff moves. “The activity data have begun to show clearer signs of below-potential growth," the note said.

While Goldman continues to forecast a rate cut in September, it does not expect the Fed to strongly signal that move this week. “If asked about the two-cut baseline in the June dot plot, Chair Powell is likely to acknowledge it, but emphasise that decisions will be made meeting-by-meeting, with two rounds of inflation and employment data still due before September," the note added.

Market Expectations

According to the CME Group’s FedWatch tool, market participants largely agree with the no-cut scenario for July. As of now, 98% of traders expect the Fed to maintain current rates, with only 2% anticipating a rate cut.

Looking ahead, the outlook for rate cuts in 2025 remains divided. The Fed’s latest Summary of Economic Projections reveals that seven FOMC members see no cuts this year, while eight expect two 25-basis-point cuts.

For the September meeting, the CME FedWatch tool shows 65% of market participants expect a 25-bps cut, while 34% expect rates to stay unchanged. Just 1% foresee a deeper 50-bps cut.

Analysts Say Fed Will Wait for Clear Weakness

“The Fed is likely to wait for meaningful signs of weakness in the labor market before acting," said Madhavi Arora, economist at Emkay Global Financial Services. “They will likely look through any transitory price spikes caused by tariffs. That makes September the more probable window for the next cut."

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a...Read More

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a...

Read More

Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. Get in-depth analysis, expert opinions, and real-time updates—only on News18. Also Download the News18 App to stay updated!

view commentsLocation : First Published:News business US Fed Likly To Hold Interest Rates Amid Political Pressure

Disclaimer: Comments reflect users’ views, not News18’s. Please keep discussions respectful and constructive. Abusive, defamatory, or illegal comments will be removed. News18 may disable any comment at its discretion. By posting, you agree to our Terms of Use and Privacy Policy.

Read More

1 day ago

1 day ago