Reeves claims freezing tax thresholds does not breach Labour's manifesto - while admitting this sounds like 'semantics'

Rachel Reeves has held a Q&A with reporters at a hospital. After two relatively neutral questions, she called Beth Rigby, the Sky News political editor, who went full Kemi Badenoch. Rigby said that Reeves suggested in her budget speech last year that freezing tax thresholds would be a breach of the manifesto, and she went on: “How in good conscience can you stay on in your job?”

Reeves said that the manifesto referred to the rates of income tax and VAT.

But she also said she was “not going to get into semantics”. She said she accepted that, by freezing thresholds, she was asking people to pay more.

Rigby tried again. She said the IFS say the manifesto promise has been broken.

Reeves replied:

If you read the manifesto, we’re very clear. We say the rates of income tax, national insurance and VAT. But if you are asking, does this have a cost for working people? I acknowledge it does. As I said that in the budget last year. I’m not going to pretend otherwise today.

In fact, the manifesto was not clear. It said:

Labour will not increase taxes on working people, which is why we will not increase national insurance, the basic, higher, or additional rates of income tax, or VAT.

At the time, most policy specialists took the second half of that sentence as the operative part, and many of them are willing to accept that freezing thresholds, while it breaks the spirit of the manifesto, does not break the letter of it.

But other people would argue that “Labour will not increase taxes on working people” is the key clause in the manifesto sentence. And one person who has suggested this is the Rachel Reeves who delivered her budget speech last year. At the time she said:

Having considered the issue closely, I have come to the conclusion that extending the threshold freeze would hurt working people. It would take more money out of their payslips.

I am keeping every single promise on tax that I made in our manifesto, so there will be no extension of the freeze in income tax and national insurance thresholds beyond the decisions made by the previous government.

From 2028-29, personal tax thresholds will be uprated in line with inflation once again.

This passage only makes sense if you assume that freezing thresholds would be a breach of the manifesto. A lawyer would argue that it’s the “so” in the middle of the second paragraph gives it away.

Key events 7m ago Racing celebrates ‘Axe the Tax’ Budget campaign victory 20m ago Best budget day for UK gilts since 2006 23m ago Gordon Brown says Reeves has done more to tackle child poverty in 1 budget than Tories did in 14 years 33m ago Torsten Bell: OBR report blunder was "incredibly serious" 1h ago What the opposition parties are saying about the budget 1h ago Reeves claims freezing tax thresholds does not breach Labour's manifesto - while admitting this sounds like 'semantics' 2h ago TUC welcomes budget, but Unite says 'wrong decisions are being made' because very wealthy left 'largely unscathed' 2h ago City experts sceptical about budget plans 2h ago Pay-per-mile scheme for electric vehicles, and other budget measures, will cut EV sales by more than 100,000, OBR says 2h ago Bank shares rally after windfall tax is swerved 2h ago Household enegy costs to drop 2h ago OBR's Miles: budget is an old-fashioned Keynesian demand boost in the near term 2h ago IFS queries whether spending restraint planned by Reeves for end of decade is realistic 3h ago Campaigners dismiss 'mansion tax' as 'superficial fix', as Treasury says it is only set to raise £430m 3h ago Will OBR chief resign over damaging release of its EFO? 3h ago Treasury claims poorest 10% of households will benefit most proportionately from budget 3h ago Track how income tax threshold freeze will hit your income 4h ago North Sea transition plan released 4h ago Markets unruffled by budget 4h ago Tax take heading to record high 4h ago Badenoch says budget 'littered with broken promises' 4h ago Badenoch says Reeves will go down as Britain's worst chancellor 4h ago Reeves claims she has not broken Labour's manifesto promises on tax 4h ago Reeves says axing ECO scheme will cut average household bills by £150 on average 4h ago Deutsche Bank: third largest tax-raising Budget since 2010. 4h ago Reeves says two-child benefit cap to go from April next year 4h ago Reeves says remote gambling duty rising to 40%, raising more than £1bn 5h ago Reeves confirms new tax being introduced for electric cars 5h ago Reeves confirms council tax surcharge, or 'mansion tax', for homes worth more than £2m 5h ago Reeves claims tax reforms will mitigate impact of extra three-year thresholds freeze 5h ago Reeves says mineworkers to get access to reserves in their pension fund 5h ago Salary sacrifice pension contributions over £2,000 to be liable for national insurance, OBR document says 5h ago Reeves says debt will fall by end of forecast 5h ago New GDP growth forecasts largely worse than before 5h ago Reeves says she will cut Isa allowance - unless some of it invested in stocks and shares 5h ago Reeves says downgraded productivity growth forecasts are 'Tories' legacy' 5h ago Reeves says OBR has updated growth forecast for 2025 from 1% to 1.5% 5h ago Reeves starts budget statement by saying early release of OBR report 'deeply disappointing' and 'serious error' 5h ago OBR report: the key points 5h ago Shadow chancellor Mel Stride says 'leak' of OBR report could be criminal offence 6h ago UK borrowing costs fall as budget 'doubles fiscal headroom' 6h ago OBR apologises for accidental early release of its budget report 6h ago OBR downgrades medium-term productivity growth to 1%, from 1.3% forecast in March 6h ago Budget to create £22bn headroom, OBR report says 6h ago OBR leak shows taxes rising to a record high, Lib Dem leader Ed Davey says 6h ago Badenoch calls for inquiry into budget leaks 6h ago Income tax thresholds will be frozen for another three years, to 2030-31 in budget, Reuters says 6h ago Leaked OBR forecasts say GDP to grow by 1.5% over forecast period 6h ago Farage says Reform UK will pay legal costs of farmers arrested at Westminster protest 6h ago Starmer tells cabinet budget 'not a spreadsheeet', but about choices 'centred in fairness' 6h ago Reeves leaves Downing Street ahead of budget 7h ago TUC general secretary Paul Nowak dismisses concerns about minimum wage rate rises as 'scaremongering' 8h ago What newspaper front pages are saying about the budget 8h ago Resolution Foundation warns minimum wage rises for younger workers could do 'more harm than good' 8h ago Farmers stage budget day protest in Whitehall - despite Met police telling them to stay away 9h ago Darren Jones says some pre-budget leaks have been 'unacceptable, and not very helpful' 9h ago Reeves says budget will involve 'fair and necessary' choices 9h ago Budget to target cost of living crisis as Reeves battles to keep Labour MPs on side Show key events only Please turn on JavaScript to use this feature

And here is the latest edition of the Guardian’s Politics Weekly podcast, featuring John Harris, Pippa Crerar and Kiran Stacey talking about the budget.

Here is a Guardian video explaining measures how the measures in the budget may affect you.

Racing celebrates ‘Axe the Tax’ Budget campaign victory

Greg Wood

Lord Charles Allen, the chair of the British Horseracing Authority, paid tribute on Wednesday to “everyone who has played their part across the sport” following the budget announcement by the chancellor, Rachel Reeves, that the rate of duty for betting on horse racing will remain unchanged at 15%.

Confirmation that racing would be exempt from tax hikes on online casino gaming as well as betting on football and other sports follows a seven-month campaign under the slogan “Axe The Racing Tax”, which initially launched in response to a Treasury proposal to “harmonise” the duty paid on both betting and gaming at a single rate.

Instead, the chancellor opted for a new regime on gambling duty with a focus on online games of chance, which are associated with significantly higher rates of gambling-related harm than single-event betting. Remote Gaming Duty (RGD), the tax paid on profits from online slots and casino games, will effectively double, from 21% to 40%, and while the tax rate for online betting on sports other than racing will rise from 15% to 25%, there is no change to the rate on either machine gaming or sports betting in high-street shops….

More here:

The release of the entire budget 40 minutes early was not the only Office for Budget Responsibility mistake today. In a far more minor error, it has also admitted getting a number wrong in a passage in its report about the impact of the pay-per-mile scheme, and other budget measures, on electric vehicle sales. (See 3.58pm.)

The report says:

Overall, as a result of this measure [the pay-per-mile scheme], we estimate there will be around 440,000 fewer electric car sales across the forecast period relative to the pre-measures forecast, with 130,000 of this offset by the expected increase in sales due to other budget measures described below.

The OBR says it should read:

Overall, as a result of this measure, we estimate there will be around 440,000 fewer electric car sales across the forecast period relative to the pre-measures forecast, with 320,000 of this offset by the expected increase in sales due to other Budget measures described below.

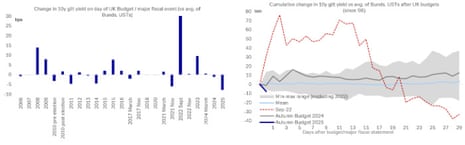

Best budget day for UK gilts since 2006

Deutsche Bank analysts have spotted an interesting fact – this was the best Budget day for UK government debt, compared to German and American debt, in almost 20 years!

They report:

At first glance, the gilt market likes what it heard from the Chancellor today.

In fact, benchmarked relative to Bunds and US Treasuries, at the time of writing today marks the largest fall in 10y gilt yields on the day of a UK budget or major fiscal statement since 2006.

Gordon Brown says Reeves has done more to tackle child poverty in 1 budget than Tories did in 14 years

The decision to scrap the two-child benefit cap has been warmly welcomed by charities, thinktanks, anti-poverty campaigners and Labour MPs.

The Institute for Fiscal Studies says:

The abolition of the two-child limit will cost £3bn per year in 2029-30, benefiting 560,000 families with an average gain of over £5,300. This is one of the most cost-effective ways to quickly address child poverty, and the government estimate it will reduce child poverty by 450,000 in 2029-30. Children in families of three or more children had relative poverty rates of almost 44% in 2023-24, compared to 24% for those in smaller families, and the rise in child poverty seen over the 2010s was entirely driven by larger families.

And the Women’s Budget Group, another thinktank, says single parents will benefit in particular. Sara Reis, its interim director, said:

Lifting the two-child limit is a landmark step towards tackling child poverty in the UK. Our analysis shows that ending the two-child limit will lift over half a million children out of poverty by the end of the decade - restoring dignity, hope, and opportunity to hundreds of thousands of families.

This change will be particularly transformative for single parents, who make up more than half of the households hit by the policy, with the majority headed by women who are more likely to skip meals or get into personal debt to cover daily living costs. It also means an end to the horrific requirement on women to prove they were raped in order to qualify for the exemption. It’s encouraging to see the government listening to experts and taking the evidence seriously, ending a policy that has deepened hardship for the most vulnerable and punished children.

However, for some families this relief will be short lived when they find their income is still subject to the benefit cap, which limits the total amount of social security households can receive unless they earn the equivalent of 16 hours at minimum wage. For single parents, most of whom are women, balancing parenting and paid work is harder than for dual parent households so it is no surprise that they make up nearly 70% of families whose benefits are capped. Over half of capped single parent households have a youngest child under five years old.

Gordon Brown, the former Labour PM, says in a New Statesman article that Rachel Reeves has “done more to transform the lives of 450,000 of Britain’s poorest children than any of the seven previous Conservative chancellors, who, in 14 long years, did nothing but harm to the lives of vulnerable children”.

Torsten Bell: OBR report blunder was "incredibly serious"

The pensions minister, Torsten Bell, has said Britain’s fiscal watchdog committed an “incredibly serious breach of the budget process” by accidentally releasing its report on the budget two hours early, before the chancellor had announced her measures.

Speaking to The News Agents podcast, Bell said:

“The OBR is going to have to think very seriously about what happened today. That was an incredibly serious breach of the budget process.”

Bell didn’t explicitly rule out even more taxes in a year time, when asked if this were posssible, saying:

‘Well, what we are doing is making sure that we are doubling down on growth, but also making sure that we’re cutting borrowing every single year and doubling the headroom against our fiscal rules to provide stability to the public finances.’

The Tribune group of Labour MPs, which has recently been revitalised to represent backbenchers from the soft left, has welcomed the budget. In a statement it said;

The Tribune group executive committee welcomes the chancellor’s budget. It was a Labour budget, demonstrating Labour values.

In particular, we are pleased to see the decision to remove the two-child limit on benefits - a reform that is not only the right and moral choice, but also economically sensible. As the cchancellor noted, abolishing the two-child limit will lift around 450,000 children out of poverty, and alongside other measures, may reduce child poverty more than at any Budget this century.

However, the premature leak of the full budget by the Office for Budget Responsibility (OBR) before the chancellor’s statement reinforces our long-standing view that the OBR’s processes demand urgent reform. If fiscal forecasting and reporting are to underpin long-term public investment and social policy, the institution must be accountable, transparent, and fit for purpose.

And Georgina Lee from Channel 4 News has posted this on social media explaining why the Resolution Foundation focused on Westminster. (See 5.08pm.) More than a quarter of homes sold there are worth more than £2m.

NEW: I've crunched the stats and these are the places that could have highest proportion of mansion tax payers after today's #budget.

In Westminster and Kensington & Chelsea, more than a quarter of homes sold in the last three years were worth over £2m. pic.twitter.com/nn5ZZSFZ8c

The Resolution Foundation thinktank says, even with the “mansion tax” (see 3.14pm), somone with a £5m home in Westminster London will still pay less (as a proportion of the value of their home) than someone with a band B home in Sunderland.

Even after the mansion tax is applied, the owner of a £5m home in Westminster will pay proportionately less in property tax than the owner of a £210k Band B property in Sunderland. pic.twitter.com/zyPjxeAmzH

— Resolution Foundation (@resfoundation) November 26, 2025The budget is good for UK assets, argues Ales Koutny, head of international rates at investment platform Vanguard Europe.

Vanguard believes today’s announcement is “an opportunity to add gilts at the long-end” – eg, buy long-dated UK government debt.

Koutny reports that fears of volatility in the gilt market have subsided since investors learned the UK has doubled its headroom to hits its fiscal rules, allowing a relief rally to break out.

Koutny adds that Vanguard is betting that UK debt will outperform German bonds, and that the poudn will strengthen against the euro, saying:

“Vanguard maintains high conviction in the positioning of our Global Core and Global Strategic Bond Funds: long UK 30-year gilts versus short 30-year Bunds, reflecting increased German supply, reduced UK long-end issuance, and relative curve steepness.

We also hold a tactical long GBP versus EUR view, expecting sterling to outperform now that budget-related uncertainty has cleared.”

What the opposition parties are saying about the budget

Here is some more reaction to the budget from opposition parties.

From Ed Davey, the Lib Dem leader

This was a botched budget delivered by a chancellor who has diagnosed the disease, but refuses to administer the cure.

This government has chosen to reject the single biggest thing it could do to turbocharge economic growth and repair the £90bn Brexit black hole.

Labour was elected on a promise of tackling the cost of living crisis and growing the economy - and this is the second budget where it’s failed to do either. For millions of people struggling with higher bills, all this budget really offers is higher taxes.

From Adrian Ramsay, the Green party’s Treasury spokesperson

Instead of delivering a transformational budget to tax extreme wealth fairly and tackle the cost-of-living crisis, this Labour government has once again chosen to paper over the cracks - with half-measures that won’t do enough to fix the deep-rooted problems in our economy that are keeping ordinary people in poverty while the super-rich get richer.

The chancellor spoke about asking everyone to make a contribution, but it is frankly inexcusable that she has made the political choice to squeeze households already struggling with the cost of essentials, whilst letting multimillionaires and billionaires off the hook.

It is indefensible that the chancellor is cutting vital home insulation funding, one of the best ways to lower bills.

And whilst scrapping the cruel two-child benefit cap will be a huge relief to families across the country, it is unforgivable that it has taken 18 months for the chancellor to acknowledge the terrible harm and distress this cap has caused to so many families. Far more action is needed to end the scandal of child poverty.

From Stephen Flynn, the SNP leader at Westminster

This was Keir Starmer and Rachel Reeves’ last budget. They promised change but have delivered complete chaos, higher energy bills, higher food prices and a soaring cost of living - it’s no wonder their own MPs are now plotting to get rid of them” - after the chancellor imposed billions of pounds of cuts and tax hikes to fill the black hole in the Labour government’s finance.

From Rhun ap Iorwerth, the Plaid Cymru leader

This budget makes one thing clear: Wales is being short-changed again.

Nothing in today’s announcements changes the fundamental unfairness facing our nation.

We have weaker fiscal powers than any other devolved nation, meaning less ability to invest in our economy, and the Treasury continues to withhold over £4bn owed to Wales in transport funding. There was no action on increased national insurance or inheritance tax costs which are pushing the Welsh public and private sectors to breaking point. Labour promised change but today proves there is none.

On taxation, Labour’s pick-and-mix approach is dishonest and chaotic. Rather than targeting the wealthiest and the big banks through wealth taxes, Rachel Reeves has chosen to freeze income tax thresholds for those in work, a dishonest and unfair wait to raise further revenue. Weeks of U-turns, last-minute announcements, and mixed messages have left households and businesses confused, undermining confidence in the economy. Labour has no plan – and the people of Wales deserve better.

The Reform UK reaction is at 4.35pm.

And there are extracts from Kemi Badenoch’s response in the chamber on behalf of the Conservatives at 1.47pm and 1.57pm. Here full speech is here.

Peter Walker

Peter Walker is the Guardian’s senior political correspondent.

At a press conference on Wednesday afternoon, Nigel Farage, the Reform UK leader, condemned what he called a budget which would do nothing to help an economy “on the edge of a precipice”.

Speaking alongside Zia Yusuf, Reform UK’s head of policy who tends to speak most commonly on economic issues, Farage reiterated previously-announced Reform proposals to cut taxes by reducing spending, with cuts particularly focused on overseas nationals, including those from the EU with settled status.

In another theme he airs frequently, Farage said he believed a general anti-business sentiment would see more wealthy people and entrepreneurs leave the UK.

“My prediction is the exodus will continue, the exodus will accelerate,” he said, blaming what he called “signals from a government that literally doesn’t understand business, because none of them have ever been in business”.

Reeves claims freezing tax thresholds does not breach Labour's manifesto - while admitting this sounds like 'semantics'

Rachel Reeves has held a Q&A with reporters at a hospital. After two relatively neutral questions, she called Beth Rigby, the Sky News political editor, who went full Kemi Badenoch. Rigby said that Reeves suggested in her budget speech last year that freezing tax thresholds would be a breach of the manifesto, and she went on: “How in good conscience can you stay on in your job?”

Reeves said that the manifesto referred to the rates of income tax and VAT.

But she also said she was “not going to get into semantics”. She said she accepted that, by freezing thresholds, she was asking people to pay more.

Rigby tried again. She said the IFS say the manifesto promise has been broken.

Reeves replied:

If you read the manifesto, we’re very clear. We say the rates of income tax, national insurance and VAT. But if you are asking, does this have a cost for working people? I acknowledge it does. As I said that in the budget last year. I’m not going to pretend otherwise today.

In fact, the manifesto was not clear. It said:

Labour will not increase taxes on working people, which is why we will not increase national insurance, the basic, higher, or additional rates of income tax, or VAT.

At the time, most policy specialists took the second half of that sentence as the operative part, and many of them are willing to accept that freezing thresholds, while it breaks the spirit of the manifesto, does not break the letter of it.

But other people would argue that “Labour will not increase taxes on working people” is the key clause in the manifesto sentence. And one person who has suggested this is the Rachel Reeves who delivered her budget speech last year. At the time she said:

Having considered the issue closely, I have come to the conclusion that extending the threshold freeze would hurt working people. It would take more money out of their payslips.

I am keeping every single promise on tax that I made in our manifesto, so there will be no extension of the freeze in income tax and national insurance thresholds beyond the decisions made by the previous government.

From 2028-29, personal tax thresholds will be uprated in line with inflation once again.

This passage only makes sense if you assume that freezing thresholds would be a breach of the manifesto. A lawyer would argue that it’s the “so” in the middle of the second paragraph gives it away.

With the budget out of the way, the Bank of England could now see its way clear to cutting interest rates before Christmas.

The BoE is scheduled to set interest rates on 18 December, and the markets indicate there is an 85% chance of a cut, from 4% to 3.75%.

Laith Khalaf, head of investment analysis at brokerage AJ Bell, says:

“From an inflationary perspective, the rise to the minimum wage isn’t helpful, though clearly some good news for lower paid workers.

However, the cut to household energy bills means that overall this Budget reduces inflation by 0.3% next year according to the OBR, so the coast is clearer for a loosening in monetary policy. It’s now over to the Bank of England to deliver on that score. The Bank is already widely expected to deliver a Christmas rate cut in December, but the Budget’s dampening of inflation should pave the way for more cuts next year.

1 month ago

1 month ago