HomeMarket NewsVedanta could see 10–14% upside from demerger, says Sohum Asset Managers’ Sanjay Parekh

Sanjay Parekh, Founder and Chief Investment Officer at Sohum Asset Managers, reiterated his positive view on Vedanta, pointing to significant value unlocking from the proposed separation of its businesses.

Sanjay Parekh, Founder and Chief Investment Officer at Sohum Asset Managers, remains bullish on Vedanta and believes the stock could see a 10–14% upside purely from the proposed demerger, driven by value unlocking across its businesses.

Parekh said Vedanta has been part of his portfolio for over 18 months, even through periods of sharp volatility, as the long-term value creation story remains intact.

At present, Vedanta trades at around 5.5 times EBITDA, which Parekh believes does not fully reflect the value of its individual businesses. Once the demerger is completed, he expects each entity to attract better valuations as they operate independently with sharper strategic focus.

He pointed out that the aluminium business, once separated, has the potential to be valued at higher multiples, while the power business, with around 5,000 megawatts of capacity, also offers scope for re-rating.

Read Here | Vedanta NCLT Approval: Here's how the demerged entity will look like

Based on a sum-of-parts valuation, Parekh said his fair value estimate for Vedanta was in the range of ₹670–680 per share even before the demerger announcement. With the restructuring now in play, he believes the stock has additional upside of at least 10–14%.

On concerns around the corporate guarantee linked to ongoing litigation in the energy business, Parekh said this was largely expected. He explained that in production-sharing contracts, certain costs are often contested and such guarantees are not unusual. While the total guarantee amount is sizeable, it is still unclear how much of it will actually crystallise. Even if a small portion does, Parekh believes the impact on the stock would be limited and not a major overhang.

Parekh also spoke about what investors would like to hear from the management going forward. He acknowledged that Vedanta’s journey over the years has been challenging, but credited the company for paying close to ₹90,000 crore in dividends despite difficult conditions. According to him, this reflects a clear intent towards shareholder value creation.

However, he said the key concern for the market remains the possibility of large, unrelated expansions or acquisitions outside the company’s core businesses. From a shareholder’s perspective, he believes management needs to reassure investors that it will stay disciplined and avoid over-adventurous moves that could dilute value.

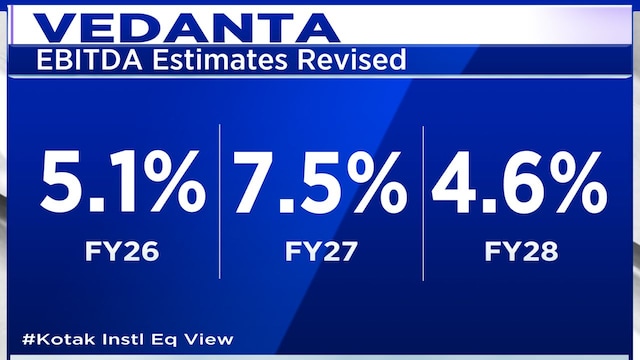

Kotak Institutional Equities has upgraded Vedanta to ‘Buy’ and set a target price of ₹650. The brokerage has also revised its EBITDA estimates, raising projections by 5.1% for FY26, 7.5% for FY27, and 4.6% for FY28.

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

(Edited by : Unnikrishnan)

1 month ago

1 month ago