HomeMarket NewsStocks NewsWhy Bernstein is sticking to Eternal’s ₹370 target despite leadership reshuffle

October–December quarter 2025 (Q3FY26) results and Blinkit’s profitability underpin Bernstein’s outlook on Zomato, even as leadership changes weigh on near-term sentiment, according to Jignanshu Gor, Director & Senior Research Analyst at Bernstein.

By Alpha Desk January 22, 2026, 2:39:15 PM IST (Published)

Bernstein has stuck to its ₹370 target price for Eternal, Zomato's parent, saying its valuation approach reflects where the company is in its growth journey.

Instead of using a sales based metric (enterprise value to sales), the brokerage is valuing the company based on its operating earnings (EV-to-adjusted earnings before interest, tax, depreciation, and amortisation), which it believes is more appropriate at this stage.

According to Jignanshu Gor, Director & Senior Research Analyst at Bernstein, the brokerage is applying a 35x (times) multiple on the food delivery business and a 30x multiple to the quick commerce segment.

Zomato delivered good performance in the October–December quarter of 2025 (Q3FY26), propelling its stock towards the ₹300 mark. The results came alongside a significant leadership transition, with Deepinder Goyal stepping down as Chief Executive Officer to become Vice Chairman, and Albinder Dhindsa taking over day-to-day operations. Gor shared his insights on the company’s performance and future trajectory.

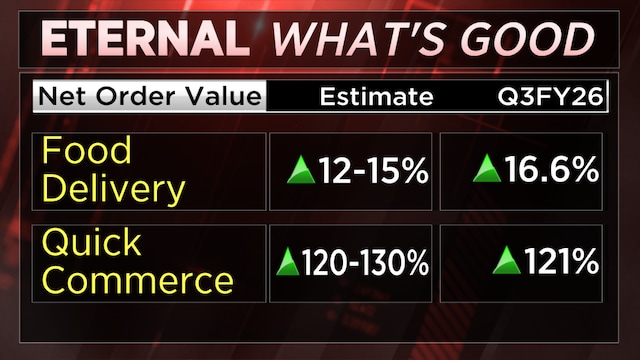

Breaking down the numbers, Zomato’s quick commerce arm, Blinkit, was the star performer. It grew 121% and turned adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) profitable in Q3. Gor said this was a positive surprise but cautioned that profitability may remain volatile over the next few quarters, a sentiment the company has also echoed.

Bernstein now pencils in an 80% growth in net order value (NOV) for Blinkit by FY27, with the segment achieving a positive EBITDA margin of 0.5% to 0.7% on a full-year basis by then. However, some volatility is expected in Q4FY26 and the subsequent Q1FY27.

On the core food delivery business, Gor said it is at the “peak of its powers” from both a performance and narrative standpoint. He views it as a steady growth engine, forecasting 15–17% growth over the next three years. He expects its adjusted EBITDA to remain stable, between 5.2% and 5.5% of NOV. In Bernstein’s valuation model, the food delivery business accounts for approximately 25–27% of the company’s total value.

Also Read: Bernstein flags these key challenges for Swiggy, Eternal in 2026

The competitive landscape in the quick commerce space is intensifying. Gor confirmed that major players, including Swiggy, are aggressively competing through increased discounts and reduced minimum order values for free delivery. "We expect that the growth will be a little challenging or will have to be bought a little, either with discounts or with more advertising," Gor said. He described the situation as a "knife fight" that will likely lead to "some bleeding across multiple players" over the next two quarters.

Also Read: Eternal's quick commerce turns profitable as Goyal exits, Dhindsa steps in

On the leadership reshuffle, Gor believes the transition will be a “hotly debated topic” and is likely to be viewed as a “net negative in the short to medium term.” He explained that this is because the business model is still evolving, and the stock price had benefited from a “halo effect” associated with Deepinder Goyal’s success. "There is some narrative pullback which might happen, but I think given the operational performance, numbers become more important anyway, and given this performance, the stock should do well," Gor added, reaffirming a bullish stance.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Track Q3 results live here

Also, catch the latest Budget 2026 expectations updates here

4 weeks ago

4 weeks ago